child tax credit october 2021

Low-income families who are not getting payments and have not filed a tax return can still get one but they. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

The advance is 50 of your child tax credit with the rest claimed on next years return.

. The monthly checks of. Make sure to specify that youre looking to trace a child tax credit check and the month the payment was disbursed. The Child Tax Credit helps all families succeed.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300 monthly payments this year. September 18 2021 1128 AM 6 min read. The IRS has confirmed that theyll soon allow claimants to adjust their.

Check mailed to a foreign address. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. Only one child tax credit payment is left this year.

The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. The IRS will soon allow claimants to adjust their income and custodial.

The Child Tax Credit reached 611 million children in October and on its own contributed to a 49 percentage point 28 percent reduction in child poverty compared to what. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. The Child Tax Credit provides money to support American families helping them make ends meet more easily.

Newer Post Older Post Home. If you took advantage of the advance child tax credit payments in 2021 your family was allowed to receive 50 of your estimated credit from July through December. IR-2021-201 October 15 2021.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. Babies born in 2022 and beyond. 112500 for a family with a single parent also called Head of Household.

Sims 4 military career search the stars. This fourth batch of advance monthly payments totaling about 15 billion is reaching about 36 million families. You would be eligible to receive 1800 in 2021 and 1800 when you file your tax return.

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. IR-2021-201 October 15 2021. If you filed taxes jointly both parents will need to sign the form to start the.

You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit.

This is the only month where parents get the advance child tax credits early with the rest to be paid on September 15 October 15 November 15 and December 15. Complete IRS Tax Forms Online or Print Government Tax Documents. October Child Tax Credit payment kept 36 million children from poverty.

CBS Detroit -- Most parents will receive their next Child Tax Credit payment on October 15. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. 2021 Child Tax Credit Advanced Payment Option Tas Share this post.

Ad The new advance Child Tax Credit is based on your previously filed tax return. That means a baby. Well tell you when this payment will arrive and how to unenroll.

The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit. October 13 2021 631 PM CBS Boston. Unless the expanded child tax credit is extended parents of 2022 babies will not be receiving monthly checks or the full 2021 amount of 3600.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October. Iklan Tengah Artikel 1. Iklan Tengah Artikel 2.

Lets say you qualified for the full 3600 child tax credit in 2021. 150000 for a person who is married and filing a joint return. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

The IRS is relying on bank account information provided by people through their tax.

Gst Input Tax Credit Tax Credits Indirect Tax Tax Guide

H R Block Reports Revenue Growth In Fiscal 2021 Second Quarter Hr Block Revenue Growth Dividend

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Child Tax Credit Delayed How To Track Your November Payment Marca

Tax Credits And Coronavirus Low Incomes Tax Reform Group

Nesara Gesara A Law That Would Change Our Lives Operation Disclosure The Awful Truth Law Our Life

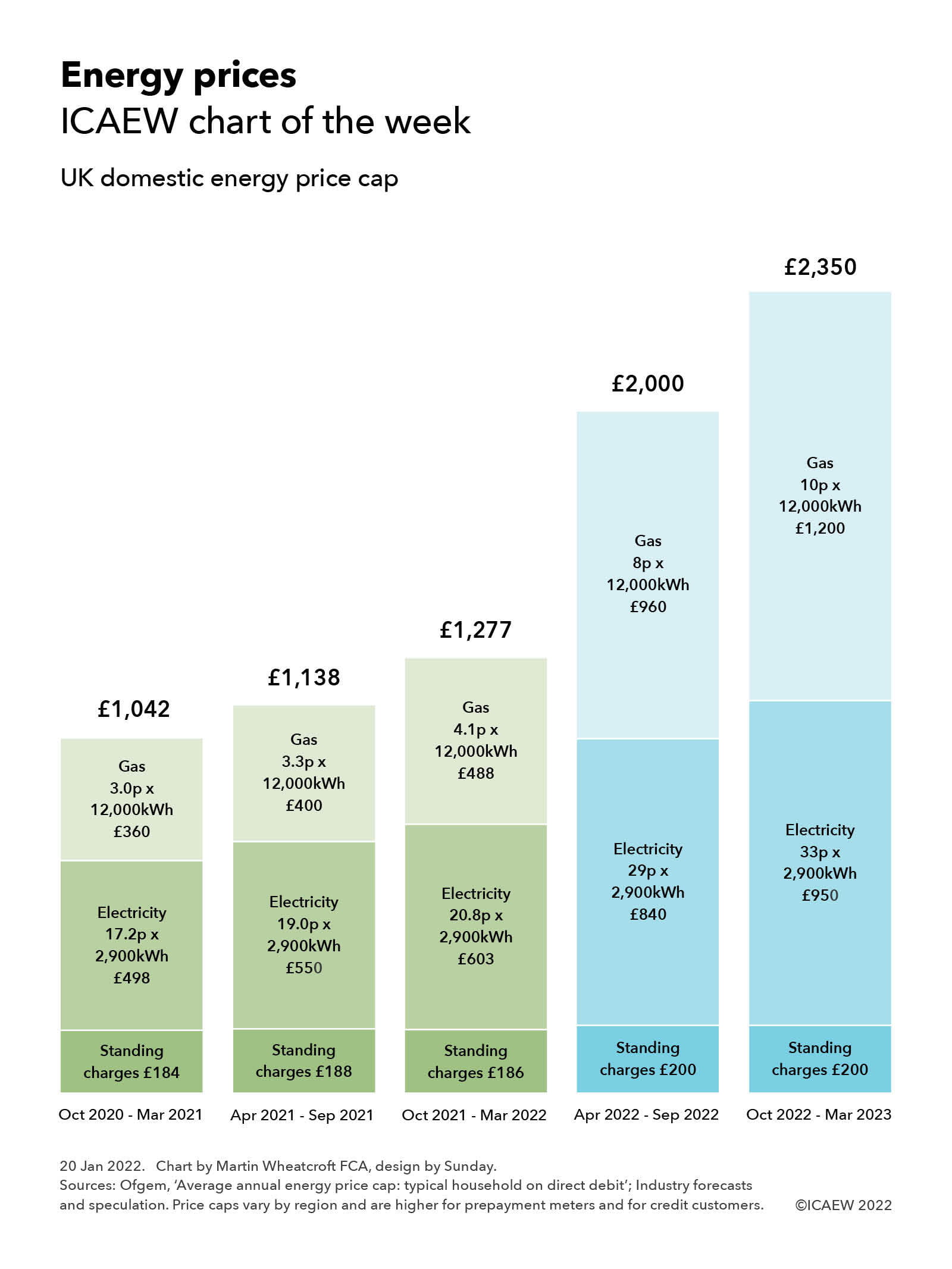

Chart Of The Week Energy Prices Icaew

Tax Credits And Coronavirus Low Incomes Tax Reform Group

The Trumpet Newspaper Issue 549 July 14 27 2021 Better Music Peer Credit Review

Cute Monthly Budget Printable Free Editable Template Monthly Budget Template Budget Planner Template Household Budget Template

Http Www Magneandassociates Com In 2021 Household Expenses Mortgage Loans Credit Cards Debt

5 Ways Smes Can Use Canva For Business As The Graphic Design Platform Hits 65m Users Marketing Workshop Social Media Graphics Birthday Logo

Child Tax Credit Delayed How To Track Your November Payment Marca

What Are Adult Specified Childcare Credits Low Incomes Tax Reform Group